How Much Does It Cost To Develop Mobile Banking Apps Like Revolut And Chase?

Mobile banking apps are digital solutions that allow users to manage their financial accounts, conduct transactions, and access various financial services through their smartphones or tablets. Mobile banking apps like Revolut and Chase have become increasingly popular over the years, as they provide users with convenient and secure access to their financial information and transactions.

What Is The Importance Of A Mobile Banking App?

Mobile banking apps have become increasingly popular in recent years, with millions of people now using their smartphones and tablets to manage their finances. These apps offer a range of benefits to both customers and banks and are now considered an essential part of the financial services landscape. In this section, we will explore some of the key reasons why mobile banking app development is important.

One of the most important reasons for the popularity of mobile banking apps is their convenience and accessibility. With a mobile banking app, customers can manage their finances from anywhere, at any time, using their smartphones or tablets. This makes it easier for customers to stay on top of their finances and reduces the need for them to visit a bank branch in person. This is particularly useful for people who are busy, have a fast-paced lifestyle, or live in rural areas where access to bank branches may be limited.

Mobile banking apps also play a crucial role in improving the customer experience. With a well-designed and user-friendly app, customers can quickly and easily access the information and services they need. This reduces the need for customers to navigate complex and confusing menus or wait in line, improving the overall experience. Additionally, mobile banking apps can offer features such as real-time notifications, biometric authentication, and personal finance management tools, further enhancing the customer experience.

Financial literacy is another area where mobile banking apps play an important role. By providing customers with real-time insights and information about their finances, mobile banking apps can help customers to better understand their spending patterns, track their expenses, and make more informed financial decisions. Additionally, mobile banking apps can also offer educational resources and tools to help customers improve their financial literacy and knowledge.

In terms of cost-effectiveness, mobile banking apps are important for banks and customers alike. By reducing the need for customers to visit a bank branch in person, mobile banking apps can help banks to lower their overhead costs. Additionally, by automating many of the tasks and processes involved in managing finances, mobile banking apps can help banks to streamline their operations, reduce errors, and improve efficiency.

The security of customers’ personal and financial information is also a crucial factor when it comes to mobile banking apps. With advanced security features such as encryption, biometric authentication, and two-factor authentication, mobile banking apps can provide a high level of protection for customers’ personal and financial information. Additionally, mobile banking apps can also help banks to reduce the risk of fraud and financial crime, by providing real-time alerts and notifications to customers.

Finally, mobile banking apps provide a range of revenue opportunities for banks. By offering new and innovative financial products and services, such as mobile payments, investment and wealth management services, and peer-to-peer lending, mobile banking apps can help banks to diversify their revenue streams and reach new customer segments. Additionally, by leveraging the data and insights gathered through their mobile banking apps, banks can also develop new data-driven revenue opportunities, such as targeted marketing campaigns and customer-specific product offerings.

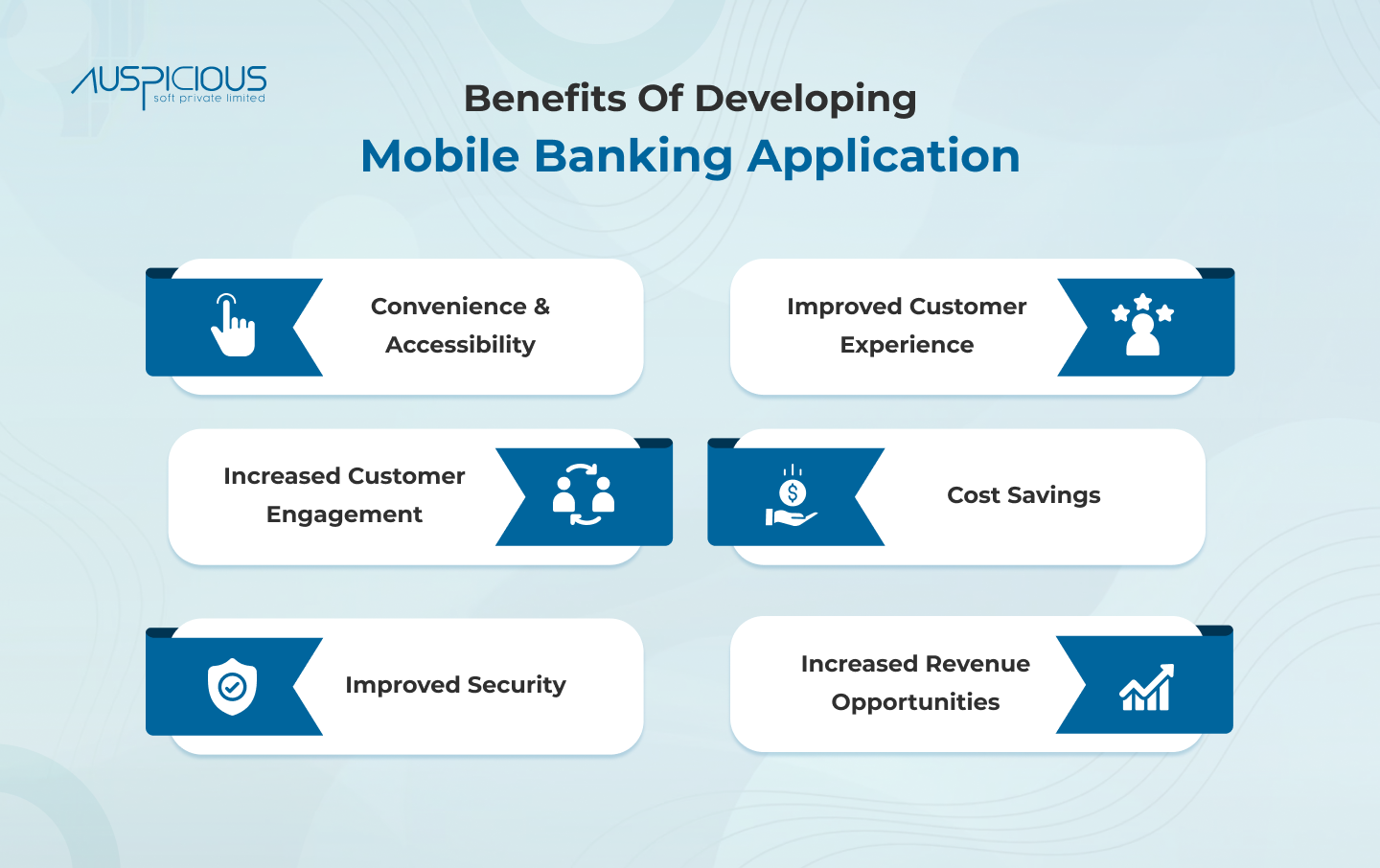

The Benefits of Developing a Mobile Banking App

Mobile banking apps are changing the way that people manage their finances. They offer a range of benefits to both banks and customers and are an increasingly important part of the financial services landscape. In this section, we will explore some of the key benefits of developing a mobile banking app.

1. Convenience and Accessibility:

One of the biggest benefits of mobile banking apps is convenience and accessibility. With a mobile banking app, customers can manage their finances from anywhere, at any time, using their smartphones or tablets. This makes it easier for customers to stay on top of their finances and reduces the need for them to visit a bank branch in person.

2. Improved Customer Experience:

Mobile banking apps can also improve the customer experience. With a well-designed and user-friendly app, customers can quickly and easily access the information and services that they need, reducing the need for them to navigate complex and confusing menus or wait in line. Additionally, mobile banking apps can offer features such as real-time notifications, biometric authentication, and personal finance management tools, which can further enhance the customer experience.

3. Increased Customer Engagement:

Mobile banking apps can also increase customer engagement. By providing customers with relevant and timely information and alerts, and offering them the tools and services that they need to manage their finances, mobile banking apps can help banks to build stronger relationships with their customers. Additionally, mobile banking apps can provide banks with valuable insights into their customers’ behavior and preferences, which can help them to tailor their services and offerings to meet the needs of their customers.

4. Cost Savings:

Mobile banking apps can also offer cost savings to banks. By reducing the need for customers to visit a bank branch in person, mobile banking apps can help banks to lower their overhead costs. Additionally, by automating many of the tasks and processes involved in managing finances, mobile banking apps can help banks to streamline their operations, reduce errors, and improve efficiency.

5. Improved Security:

Mobile banking apps can also improve security for both banks and customers. By using advanced security features such as encryption, biometric authentication, and two-factor authentication, mobile banking apps can protect customers’ personal and financial information. Additionally, mobile banking apps can also help banks to reduce the risk of fraud and financial crime, by providing real-time alerts and notifications to customers.

6. Increased Revenue Opportunities:

Finally, mobile banking apps can also provide banks with new revenue opportunities. By offering new and innovative financial products and services, such as mobile payments, investment and wealth management services, and peer-to-peer lending, mobile banking apps can help banks to diversify their revenue streams and reach new customer segments. Additionally, by leveraging the data and insights gathered through their mobile banking apps, banks can also develop new data-driven revenue opportunities, such as targeted marketing campaigns and customer-specific product offerings.

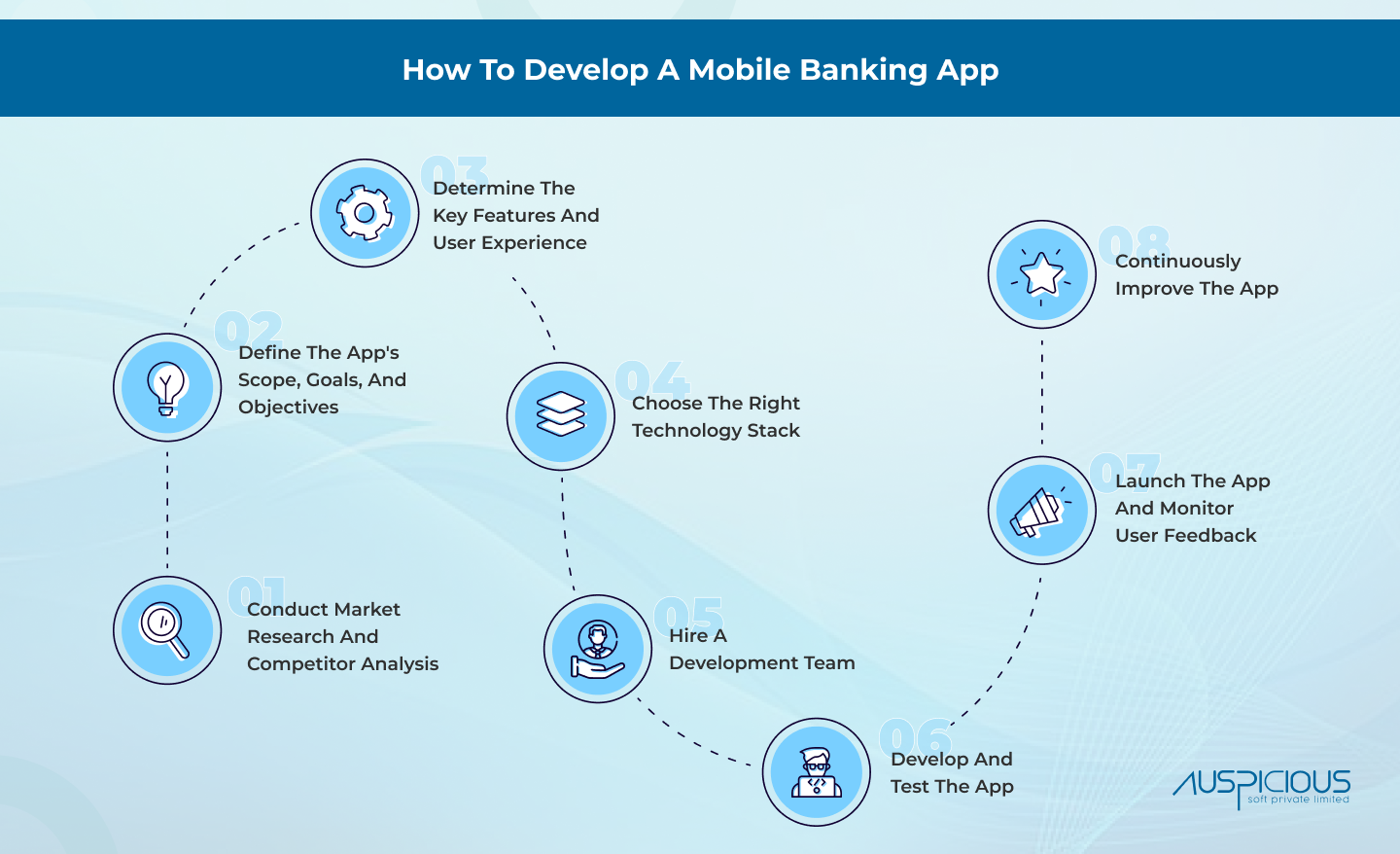

How to Develop a Mobile Banking App: A Step-by-Step Guide

Developing a mobile banking app can be a complex and challenging process, but with the right approach, it can be done successfully. In this guide, we will walk you through the key steps involved in developing a mobile banking app.

1. Conduct Market Research and Competitor Analysis:

The first step in developing a mobile banking app is to conduct market research and competitor analysis. This will help you to understand the current state of the market, identify the key players and their strengths and weaknesses, and determine the opportunities and challenges that you will face. This information will be useful when defining the scope of your app, setting your goals and objectives, and determining the key features that you need to include in your app.

2. Define the App’s Scope, Goals, and Objectives:

Based on your market research and competitor analysis, you should define the scope, goals, and objectives of your app. This will help you to clarify what you want to achieve with your app, and what your app will do for your users.

3. Determine the Key Features and User Experience:

Once you have defined the scope, goals, and objectives of your app, you should determine the key features that you need to include in your app, and design the user experience. This will involve defining the user flows, creating wireframes and prototypes, and testing your app to ensure that it meets the needs and expectations of your users.

4. Choose the Right Technology Stack:

Choosing the right technology stack is critical to the success of your mobile banking app. You should choose a technology stack that is secure, scalable, and flexible, and that provides the features and capabilities that you need. Some popular technology stacks for mobile banking apps include React Native, Xamarin, and Flutter.

5. Hire a Development Team:

Hiring a development team is the next step in the process of developing a mobile banking app. You should choose a development team that has experience and expertise in developing mobile banking apps, and that can help you to build a high-quality and secure app.

6. Develop and Test the App:

Once you have chosen your development team, you should start developing and testing your app. This will involve developing the backend systems and the frontend user interface, and testing your app to ensure that it meets your goals and objectives.

7. Launch the App and Monitor User Feedback:

After your app has been developed and tested, you should launch it and monitor user feedback. This will help you to identify any issues or bugs and make any necessary updates and improvements to your app.

8. Continuously Improve the App:

Continuously improving your app is critical to its success. You should use user feedback and analytics to identify areas for improvement and make regular updates and improvements to your app to ensure that it meets the changing needs and expectations of your users.

How Much Does It Cost To Develop A Mobile Banking App?

The cost of developing a mobile banking app can vary greatly depending on a number of factors, including the complexity of the app, the platform it is being built for, the size of the development team, and the location of the development company. In this section, we will explore these factors in more detail, and provide some rough estimates of the costs involved in developing a mobile banking app.

Factors Affecting the Cost of Development

1. App Complexity

The complexity of the app is one of the biggest factors affecting the cost of development. A simple app with basic features, such as account management and bill payment, will cost less to develop than a complex app with advanced features, such as investment and wealth management tools, real-time budget tracking, and P2P payments. The more features and functionality an app has, the more time and resources it will take to develop, and the higher the cost will be.

2. Platform

Another important factor affecting the cost of development is the platform the app is being built for. For example, building an app for iOS will generally cost more than building an app for Android, as iOS apps require more resources and expertise to develop. Additionally, if an app is being developed for multiple platforms, such as iOS and Android, the costs will be higher.

3. Development Team

The size and composition of the development team can also have an impact on the cost of development. A large team of experienced developers, designers, and project managers will cost more to hire than a smaller team of junior developers. Additionally, the location of the development company will also affect the cost, as development costs can vary greatly between different regions.

4. Customization

Finally, the level of customization required can also affect the cost of development. For example, if an app requires a custom user interface or unique features, this will add to the development time and resources required, and increase the overall cost.

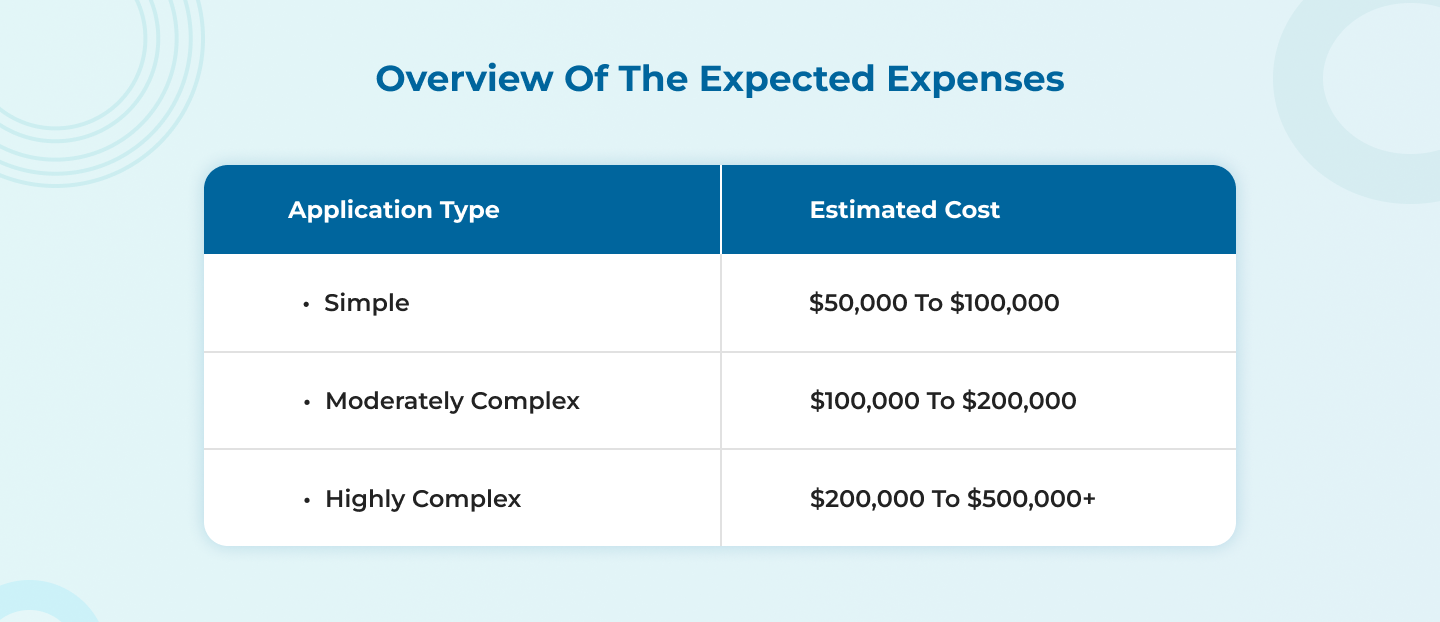

5. Estimated Costs

Based on the factors outlined above, it is possible to estimate the costs involved in mobile banking app development. These estimates should be considered rough guidelines only, as the actual cost of developing an app can vary greatly depending on the specific requirements and circumstances.

It’s important to note that these estimates are for the initial development of the app only, and do not include ongoing costs such as maintenance and updates.

How To Choose The Top Mobile App Development Company For Banking Industry?

When it comes to developing a mobile banking app, it’s crucial to choose a top-quality development company with experience in the banking industry. The right development partner can help ensure your app is built to the highest standards and provides an exceptional user experience for your customers. In this section, we will explore some key factors to consider when choosing a mobile app development company for the banking industry.

1. Experience In The Banking Industry

It’s important to choose a development company with experience in the banking industry. This ensures that the company has a deep understanding of the unique requirements and challenges involved in developing a mobile banking app. Look for a company with a proven track record of delivering successful mobile banking solutions, and a portfolio of relevant projects.

2. Technical Expertise

The company you choose should have a strong technical team with expertise in the latest mobile technologies, including cloud computing, security, and payment systems. This ensures that your app will be built using the latest and most secure technology, and will provide a seamless user experience.

3. User-Centered Design Approach

When developing a mobile banking app, it’s important to prioritize the user experience. Choose a company that uses a user-centered design approach, and puts the needs of the user first in all aspects of app development. This includes conducting user research and testing, and iterating on the design and features to ensure the app is intuitive and easy to use.

4. Project Management Approach

The company you choose should have a robust project management approach, including clear timelines, regular updates, and effective communication. This helps ensure the development process runs smoothly and efficiently, and that the app is delivered on time and within budget.

5. Cost

Finally, it’s important to consider the cost of development when choosing a mobile app development company. While it’s important to choose a company with the right skills and experience, it’s also important to ensure that the cost is within your budget. Look for a company that offers transparent pricing and a clear understanding of the costs involved in the development process.

AuspiciousSoft is a top mobile app development company with experience in the banking industry. With a team of highly skilled developers, designers, and project managers, AuspiciousSoft provides expert technical solutions for mobile banking apps, including cloud computing, security, and payment systems. The company uses a user-centered design approach, putting the needs of the user first in all aspects of app development. And with a robust project management approach, AuspiciousSoft ensures the development process runs smoothly and efficiently, delivering the app on time and within budget.

Conclusion:

Mobile banking apps like Revolut and Chase have become increasingly popular over the years, as they provide users with convenient and secure access to their financial information and transactions. Mobile app development can offer several benefits to financial institutions, including increased customer satisfaction, increased customer engagement, increased profitability, and increased competitiveness.

The cost of developing a mobile banking app can vary widely, depending on several factors, including the scope of the project, the development team, the technology stack, and the location of the development team. On average, the cost of developing a mobile banking app can range from $50,000 to $500,000 or more.

When considering the development of a mobile banking app, it is important to choose a development team that has the experience and expertise to build a high-quality app, and to carefully consider all of the factors that will impact the cost of development. By doing so, financial institutions can develop a mobile banking app that provides their customers with a convenient and secure way to manage their finances, and that helps to increase their competitiveness in the market.

TABLE OF CONTENT

- How Much Does It Cost To Develop Mobile Banking Apps Like Revolut And Chase?

- What Is The Importance Of A Mobile Banking App?

- The Benefits of Developing a Mobile Banking App

- How to Develop a Mobile Banking App: A Step-by-Step Guide

- How Much Does It Cost To Develop A Mobile Banking App?

- How To Choose The Top Mobile App Development Company For Banking Industry?

- Conclusion