How Much Does It Cost To Build Payment Apps Like Venmo?

Payment apps have revolutionized the way we handle our finances. These applications allow users to perform a variety of financial transactions, including sending and receiving money, paying bills, and even investing, all from the convenience of their smartphones. Venmo, one of the most popular payment apps, has set the bar for what people expect from a payment app. In this article, we will delve into the world of payment apps, exploring what they are, why they are important, their benefits, and what it costs to build a payment app like Venmo.

What Are Payment Apps?

Payment apps are digital platforms that allow users to perform a variety of financial transactions, manage their finances, and perform other financial activities, all from their smartphones. These apps have revolutionized the way we handle our finances, making it easier and more convenient to manage our money on-the-go.

There are two main types of payment apps: peer-to-peer (P2P) and digital wallet. P2P payment apps, such as Venmo, allow users to send and receive money directly from one another, without the need for a bank or other intermediary. This type of app is particularly useful for splitting bills, paying back friends and family, or making small purchases. P2P payment apps typically use encryption and two-factor authentication to keep users’ financial information safe and secure.

Digital wallet payment apps, such as PayPal, allow users to store their money and make purchases online. This type of app is ideal for those who want to simplify their finances and have all their financial information in one place. Digital wallet payment apps also allow users to store their credit and debit cards, making it easier to make purchases online or in-store. Some digital wallet payment apps also offer additional features, such as the ability to invest, save, and manage their money.

Why Are Payment Apps Important?

Payment apps have become increasingly important in recent years due to the growth of the gig economy, which has made it more difficult for people to manage their finances. In the gig economy, people are working multiple jobs and earning income from various sources, making it difficult to keep track of their finances. Payment apps provide a convenient and secure way for people to handle their finances, making it easier to manage their money on-the-go.

Payment apps are important for a number of reasons. Firstly, they provide users with a convenient and secure way to manage their finances. Users can perform financial transactions, view their balance, and perform other financial activities from their smartphones, making it easier to handle their finances on-the-go. This is particularly useful for people who work multiple jobs or have busy schedules, as it allows them to manage their finances from anywhere and at any time.

In addition, payment apps can help to reduce the risk of fraud. Many payment apps use state-of-the-art security measures, such as encryption and two-factor authentication, to keep users’ financial information safe. This gives users peace of mind, knowing that their financial information is protected and secure.

Another benefit of payment apps is that they are fast and efficient. Users can perform transactions quickly and easily, without the need to wait in line or fill out long forms. This can save users a significant amount of time and make managing their finances more efficient.

Payment apps are also user-friendly, with simple and intuitive interfaces that make it easy for users to navigate. This makes it easier for users to manage their finances, even if they are not tech-savvy. Furthermore, payment apps typically charge lower fees than traditional banks, making it more affordable for users to manage their finances. This can help users to save money and make managing their finances more cost-effective.

Top Benefits Of Payment Apps:

Payment apps offer numerous benefits to users, including convenience, security, speed, user-friendliness, cost-effectiveness, easy access to funds, and investment opportunities. In this section, we will take a closer look at each of these benefits in more detail.

1. Convenience:

Payment apps are designed to make managing your finances easier and more convenient. With a payment app, you can perform financial transactions, view your balance, and perform other financial activities from your smartphone, making it easier to handle your finances on-the-go. This is particularly useful for people who work multiple jobs or have busy schedules, as it allows them to manage their finances from anywhere and at any time.

2. Security:

One of the biggest concerns when it comes to handling finances is security. Payment apps use state-of-the-art security measures, such as encryption and two-factor authentication, to keep users’ financial information safe. This gives users peace of mind, knowing that their financial information is protected and secure. Payment apps are also subject to regular security audits, ensuring that they are always up-to-date with the latest security measures.

3. Speed and Efficiency:

Payment apps are fast and efficient, allowing users to perform transactions quickly and easily. This can save users a significant amount of time and make managing their finances more efficient. For example, when paying a friend for a shared expense, you can quickly send the money using the app, instead of having to wait for a check to clear or transfer funds from your bank account. This can be especially useful for small businesses that need to make quick payments to suppliers or contractors.

4. User-Friendliness:

Payment apps are designed to be user-friendly, with simple and intuitive interfaces that make it easy for users to navigate. This makes it easier for users to manage their finances, even if they are not tech-savvy. This is particularly useful for people who are new to handling their finances or who are not familiar with financial technology.

5. Cost-Effectiveness:

Payment apps typically charge lower fees than traditional banks, making it more affordable for users to manage their finances. This can help users to save money and make managing their finances more cost-effective. For example, some payment apps offer free peer-to-peer (P2P) payments, which can be a more cost-effective alternative to using a check or transferring funds from a bank account.

6. Easy Access to Funds:

Payment apps provide users with easy access to their funds. With a payment app, users can quickly and easily access their money, making it easier to manage their finances and handle unexpected expenses. This is especially useful for people who are on-the-go and need quick access to their funds.

7. Investment Opportunities:

Some digital wallet payment apps, such as PayPal, also offer investment opportunities. This allows users to invest their money, save for the future, and grow their wealth. For example, PayPal offers a savings account that pays interest on the balance. This can be a great way for users to save money and grow their wealth over time.

8. One-Stop Shop:

Digital wallet payment apps, such as PayPal, allow users to store their money and make purchases online. This type of app is ideal for those who want to simplify their finances and have all their financial information in one place. Digital wallet payment apps also allow users to store their credit and debit cards, making it easier to make purchases online or in-store.

What Is The Cost Of Building A Payment App?

Building a payment app requires a significant investment of time and resources, as well as a solid understanding of the financial technology industry. The cost of mobile app development can vary greatly depending on several factors, including the features you want to include, the complexity of the app, and the development team you work with. In this section, we will take a closer look at the cost of building a payment app and what you can expect to pay.

1. Features:

The cost of building a payment app is largely dependent on the features you want to include. For example, if you want to include a range of advanced features, such as P2P payments, invoicing, and investment opportunities, you can expect to pay more than if you only include basic features, such as the ability to view your balance and perform transactions. The more features you include, the more complex the app will be and the more it will cost to develop.

2. Complexity:

The complexity of the payment app you want to build will also impact the cost. If you want to build a simple payment app with basic features, you can expect to pay less than if you want to build a complex app with a range of advanced features. This is because complex apps require more development time, as well as more specialized development skills.

3. Development Team:

The cost of building a payment app also depends on the development team you work with. If you work with a large, established development company, you can expect to pay more than if you work with a small, independent development team. However, it is important to note that working with a large development company does not guarantee a higher quality app, and working with a smaller development team does not guarantee a lower cost.

4. Platform:

The platform you choose to build your payment app on can also impact the cost. For example, building an app for iOS will typically cost more than building an app for Android, due to the differences in development environments and development tools. Additionally, if you want to build a cross-platform app that runs on both iOS and Android, you can expect to pay even more.

5. Location:

The location of the development team you work with can also impact the cost of building a payment app. For example, if you work with a development team in the United States, you can expect to pay more than if you work with a team in India or Eastern Europe. This is because the cost of living and the cost of doing business in these countries is lower, and development teams in these countries are able to offer lower rates.

6. Maintenance and Support:

In addition to the cost of developing the payment app, you will also need to consider the cost of maintaining and supporting the app. This includes ongoing development and bug fixes, as well as customer support. The cost of maintenance and support will depend on the complexity of the app, the number of users, and the size of the development team.

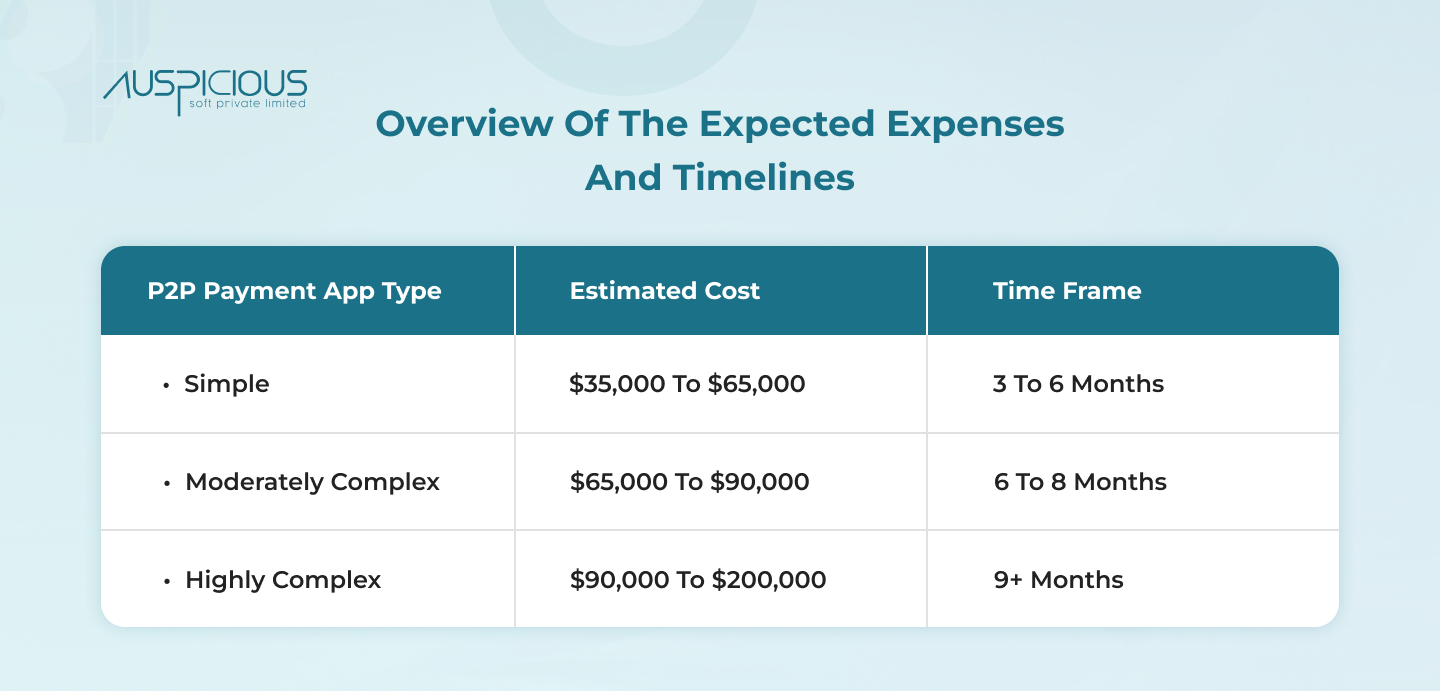

To give you a general estimate, the price to construct a P2P payment software similar to Venmo can be anywhere from $35,000 to $200,000 or more. The entire cost may also change depending on the app’s wireframe, UI/UX design, platform, development process, location, and hourly developer rates, among other variables.

Simply simply, the intricacy of the app as a whole is a key determining factor in determining how much an app will cost. For instance, a simple mobile app with a limited feature set may be less expensive than a more complex app with a large feature set.

Let’s now attempt to provide you with a quick overview of the expected expenses and timelines for developing P2P payment apps based on their complexity.

Note: These are merely ballpark figures for how much each stage of developing an app will cost.

What Is The Best Payment App Development Company?

Choosing the right payment app development company is crucial to the success of your payment app. With so many companies to choose from, it can be difficult to know where to start. However, by considering factors such as experience, expertise, cost, and customer reviews, you can find the best payment app development company for your needs.

One company that stands out in the field of payment app development is AuspiciousSoft. AuspiciousSoft is a leading payment app development company that has been providing high-quality payment app development services for many years. They have a team of experienced developers who are knowledgeable about the latest payment technologies and are committed to delivering high-quality apps that meet their clients’ needs.

One of the key reasons why AuspiciousSoft is a top choice for payment app development is their experience and expertise. The company has years of experience in the financial technology industry and has developed a range of payment apps for clients around the world. Their developers are experts in their field and have a deep understanding of the payment app development process. This experience and expertise allows them to provide high-quality apps that are easy to use, secure, and reliable.

Another factor that sets AuspiciousSoft apart from other payment app development companies is their cost-effective services. They understand that payment apps can be expensive to develop, and they strive to provide their clients with the best possible value for their investment. They offer competitive rates and are committed to delivering high-quality apps at an affordable price.

In addition to their cost-effective services, AuspiciousSoft is also known for their excellent customer service. They are committed to providing their clients with the support they need to successfully launch their payment app. Whether it’s answering questions, providing technical support, or helping to resolve any issues that arise, AuspiciousSoft is always there to help.

Finally, AuspiciousSoft has a proven track record of success. They have a long history of delivering high-quality payment apps that meet the needs of their clients. By combining their experience, expertise, cost-effectiveness, and customer service, AuspiciousSoft has established itself as a leading payment app development company.

Conclusion:

Payment apps have revolutionized the way we handle our finances, making it easier to manage our money on-the-go. These apps provide a convenient and secure way to perform financial transactions, manage our finances, and perform other financial activities, all from our smartphones. The cost of building a payment app like Venmo will depend on a number of factors, including the complexity of the app, the features you want to include, and the development team you hire.

In conclusion, payment apps provide numerous benefits, including convenience, security, speed, lower fees, and user-friendliness. Whether you are a small business owner, a freelancer, or simply someone who wants to manage their finances more efficiently, payment apps are a great investment. So, if you are looking to build a payment app like Venmo, consider the benefits and start your journey towards financial freedom today.